The Facts About The Wallace Insurance Agency Uncovered

Wiki Article

Not known Incorrect Statements About The Wallace Insurance Agency

Table of ContentsNot known Details About The Wallace Insurance Agency 10 Simple Techniques For The Wallace Insurance AgencyThe 6-Minute Rule for The Wallace Insurance Agency9 Simple Techniques For The Wallace Insurance AgencyThe 3-Minute Rule for The Wallace Insurance AgencyThe Wallace Insurance Agency - TruthsLittle Known Facts About The Wallace Insurance Agency.The Single Strategy To Use For The Wallace Insurance Agency

These strategies likewise use some defense component, to help guarantee that your beneficiary gets economic settlement needs to the regrettable occur throughout the tenure of the plan. The simplest method is to begin assuming regarding your concerns and requirements in life. The majority of individuals begin off with one of these:: Against a background of rising clinical and hospitalisation costs, you may want wider, and higher coverage for medical costs.Ankle joint strains, back strains, or if you're knocked down by a rogue e-scooter motorcyclist., or normally up to age 99.

The Best Strategy To Use For The Wallace Insurance Agency

Relying on your coverage plan, you get a lump amount pay-out if you are completely handicapped or seriously ill, or your loved ones get it if you pass away.: Term insurance policy gives coverage for a pre-set time period, e - Health insurance. g. 10, 15, two decades. As a result of the much shorter coverage period and the lack of money worth, costs are normally reduced than life plansWhen it matures, you will get a lump sum pay-out. Money for your retirement or kids's education, check. There are 4 typical sorts of endowment strategies:: A plan that lasts about 10 years, and provides yearly money benefits on top of a lump-sum amount when it matures. It normally consists of insurance coverage versus Overall and Long-term Disability, and death.

The 3-Minute Rule for The Wallace Insurance Agency

You can select to time the payment at the age when your child mosts likely to university.: This provides you with a month-to-month earnings when you retire, typically on top of insurance coverage.: This is a method of conserving for short-term objectives or to make your cash work harder against the pressures of inflation.

Some Of The Wallace Insurance Agency

While obtaining different plans will offer you a lot more extensive insurance coverage, being overly shielded isn't a good point either. To stay clear of unwanted economic stress, compare the policies that you have against this checklist (Health insurance). And if you're still unsure concerning what you'll need, exactly how a lot, or the type of insurance policy to obtain, seek advice from a Your Domain Name financial consultantInsurance policy is a long-term commitment. Constantly be prudent when picking a strategy, as changing or ending a plan too soon usually does not produce monetary advantages. Conversation with our Wealth Planning Manager now (This conversation service is available from 9am to 6pm on Mon to Fri, leaving out Public Holidays.) You may likewise leave your get in touch with information and we will certainly get in touch soon.

The Best Guide To The Wallace Insurance Agency

The finest component is, it's fuss-free we immediately work out your money flows and provide cash pointers. This write-up is suggested for info only and must not be counted upon as monetary guidance. Before making any type of decision to purchase, offer or hold any financial investment or insurance policy item, you need to inquire from an economic consultant concerning its suitability.Spend just if you recognize and can monitor your financial investment. Diversify your financial investments and prevent investing a large section of your money in a single item provider.

The Wallace Insurance Agency Things To Know Before You Buy

Life insurance policy is not always one of the most comfortable based on go over. Simply like home and auto insurance policy, life insurance is crucial to you and your household's financial security. Moms and dads and functioning adults normally require a kind of life insurance policy. To help, allow's explore life insurance policy in a lot more information, exactly how it functions, what worth it could offer to you, and exactly how Financial institution Midwest can assist you find the right plan.

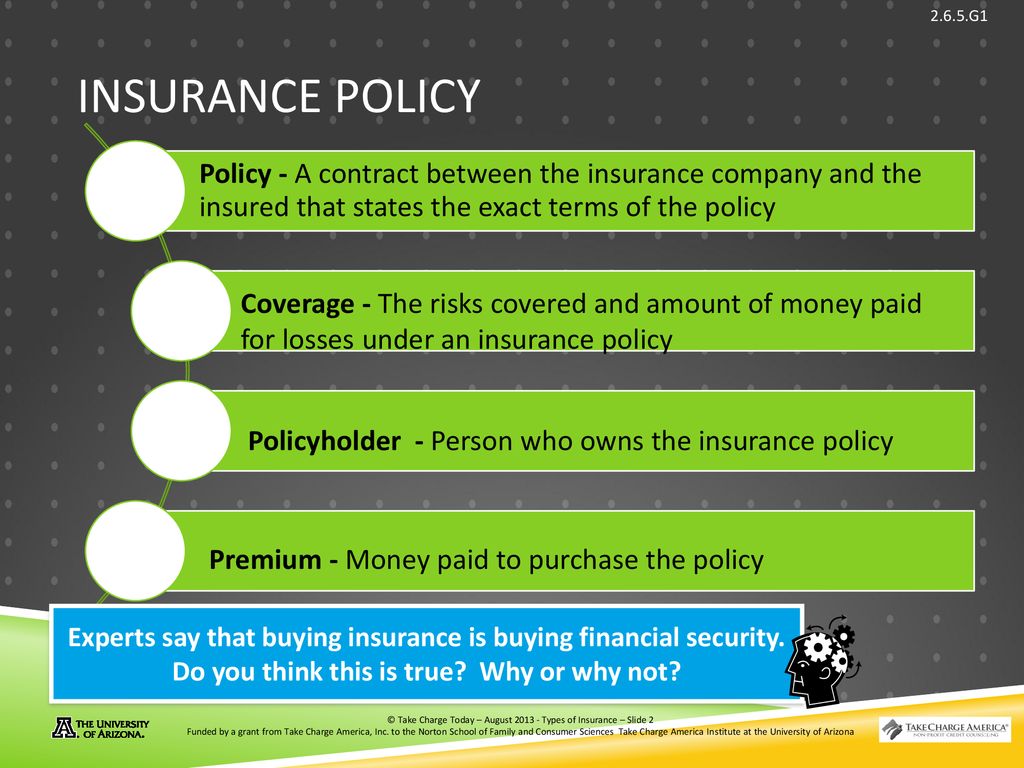

It will certainly aid your household settle financial obligation, get earnings, and reach major economic objectives (like college tuition) in the event you're not right here. A life insurance policy policy is essential to planning out these monetary considerations. In exchange for paying a monthly costs, you can obtain a set quantity of insurance coverage.

3 Simple Techniques For The Wallace Insurance Agency

Life insurance coverage is right for virtually everyone, also if you're young. Individuals in their 20s, 30s and even 40s often ignore life insurance coverage.The more time it requires to open a policy, the even more threat you face that an unanticipated occasion could leave your household without coverage or monetary help. Depending on where you go to in your life, it is essential to know exactly which kind of life insurance policy is finest for you or if you need any type of whatsoever.

How The Wallace Insurance Agency can Save You Time, Stress, and Money.

A house owner with 25 years continuing to be on their mortgage might take out a policy of the very same length. Or let's claim you're 30 and plan to have children soon. Because case, registering for a 30-year plan would secure your premiums for the following thirty years.

Report this wiki page